Comment by Carsten Bamberg, Business Development Manager, Konica Minolta Business Solutions Europe

The digital production of labels has become mainstream, with almost 35% of the total value now fully digital or involving hybrid printing. In a stunning pendulum swing, digital is out-performing the market as more brands and retailers identify agility and fast response as the critical factors in meeting rapidly changing demand patterns in a new world of opportunity.

For labels and packing in particular, the technology has not only remained resilient amid the turmoil of global challenges, there are real positives as we move forward with the analogue to digital transition. It is like the sound of charging horses moving ever more closer and getting louder. The transition is unstoppable.

Igniting opportunities with a new world of opportunities

With trends accelerating such as automation, online print purchasing and webshops, we see opportunities everywhere for customers wanting to ignite printing possibilities as they enter a new world of opportunities afforded by new applications that can only be delivered through digital production.

Workflow, software and process automation, together with cloud solutions, are key drivers for better automation and efficiencies as part of the drive towards the ‘smart factory’. Opportunities are everywhere. Labels and packaging markets continue to flourish thanks to digital printing, as run lengths continue to come down and demands increasingly grow for sustainable ways of production by reducing waste. This has become ever more important, particularly with global challenges over the availability of raw materials plus price and energy rises, as well as skills shortages that have hit confidence levels.

However, we remain extremely positive for the future. Digital label technology will continue to expand into traditional flexo and offset territory, which is good news for those already actively involved in digital production and for those wanting to invest.

Growth path on cards for labels and packaging markets

Our optimism is mirrored by other global experts who also report that significant growth opportunities look set to materialise in the coming year and beyond. A growth path after the pandemic for labels and packaging markets is the expert view from Smithers¹. In a report on trends and drivers shaping future digital print markets, the analysts revealed the near 35% figure of the total value for fully digital or hybrid label production. Digital has long reached mainstream. Smithers says that the global digital printed labels market was worth $12.6billion in 2022 last year, having grown at a CAGR (compound annual growth rate) of 7.7% since 2017, while volume grew at an average 10.8%.

“The pandemic saw significant growth in essential consumable products as industrial and bulk packaging required labels, but with demand down for many luxury products,” said the report. “Digital out-performed the market as more brands and retailers identified agility and fast response as important factors in meeting rapidly changing demand patterns.”

Digital labels printing will reach almost $20 billion by 20321, when the performance of digital narrow web presses will surpass analogue production, with digital embellishment and finishing options inline. The report also says: “As populations grow and the number of smaller households increases, packaging volumes will also grow. E-commerce with individuals necessitates more packaging to protect items in transit. While much packaging is not printed (bottles, jars, food cans, wraps, barrels, totes, bulk bags, corrugated, films) some of it requires a label.”

Labels an indispensable enabler of the critical infrastructure

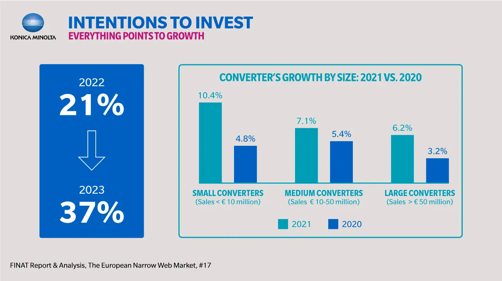

As another example of the shift to digital production, FINAT² reveals that more than a third of respondents (37%) from a recent survey said they will be purchasing a digital press in 2023. That was a significant jump from the 21% who said they would invest in digital equipment over the past year. Writing in FINAT’S latest report and analysis for the European narrow web market, the association President Philippe Voet says: “Labels are an indispensable enabler of the critical infrastructure”, adding that “label converters are reporting that their digital business has increased significantly given the pandemic and the continued need for rush-driven ordering.”

Data from research analysts IDC shows the western European digital labels and packaging production printer market is expected to increase at a CAGR of 13.1% in a five-year period to 20253.

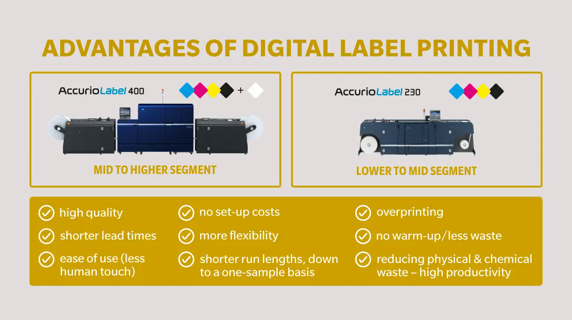

We will continue to push the boundaries with our toner-based technology that has made us market-leader in digital label production – little more than six years since we first entered the sector. Originally targeting small- and medium-sized label converters, as a global technology provider with a local service structure we are now also targeting the high-end markets with the introduction of our AccurioLabel 400 toner single-pass digital press.

First AccurioLabel 400 customers to start live production

We are on track for first installations of our new press early in 2023 following extensive internal testing and extremely positive feedback from the first public showcases of our new model. Important developments of the AccurioLabel 400 include further running cost reductions thanks to even more durable parts, availability in 4- and 5-colour configurations and the ability to expand applications with white toner and a printing speed up to 39.9 metres per minute.

“The introduction of white cannot be overstated,” says IDC in its market note. “The estimated 3,000 label converters in the mid- to high-volume space will welcome the business opportunities brought by this colour addition. The AccurioLabel 400 pushes the envelope on automation, speed, flexibility, and colour capabilities, enabling Konica Minolta to further penetrate the L&P market.” The report adds that the new press “also underlines Konica Minolta's commitment to innovation and to driving growth in the L&P market”.³

But we won’t be resting on our laurels. There is still a huge job to be done in educating the market on the benefits of digital production. In a partnership approach, we are determined to help our clients to identify and unlock the potential digitalisation that holds and to reach the next level in the digital maturity of their organisation by rethinking the workplace.

Supporting an intelligent connected workplace

In addition to continuing to cement our position as one of the major manufacturers in digital label production, we will also look at the bigger picture to help customers shape their future. In support of an “intelligent connected workplace”, Konica Minolta offers cloud, IT, managed print and video solutions services for remote working, collaboaration, workflow management and automation and security. Labels form the supply chains for basic necessities by providing a vital tool to convey information. One thing for sure is that labels will continue to be mainstream. And the pendulum swing towards digital production will become ever-more prominent.