After some challenges over the past few years in the label, packaging and embellishment industry, including Covid and a market contraction in 2023, we see a distinctly optimistic outlook on the horizon for the year ahead. Comment by Yasunori Meguro, Head of Label Business, Konica Minolta Business Solutions Europe.

With demand for labels closely related to the overall volume of packaging and with digital production now accepted as mainstream in the label conversion business, we see many new business possibilities being ignited across many sectors. Influencing this are three key trends.

Trend 1: AI and Automation

Set to be among the most industry-defining developments are the major advances in Artificial Intelligence (AI) and machine learning, both key factors in driving automation. These technologies are enabling the creation of end-to-end ecosystems that streamline processes from design to production.

With its ability to deliver precision, flexibility, and speed, digital printing is now a cornerstone for businesses navigating a landscape that demands rapid turnarounds and shorter print runs. The integration of AI is empowering businesses to rethink possibilities, enhance efficiency and reduce waste.

Trend 2: Smart labels and digital transformation

There will be increased adoption of smart labels with technology such as RFID tagging and NFC often incorporated. According to IDTechEx, the European market for RFID labels is expected to reach €2.5 billion by 2027.These will be implemented increasingly in warehousing and logistics management or promotional labelling.

Regulations governing the declaration of content, such as allergens and nutritional information – often needed in several languages – are becoming more stringent, which will also lend itself to further growth in digital production.

Trend 3: Paving the way for premiumization

And we see a growing trend towards premiumization for products in food and beverage sectors that are predominantly consumer-facing. Brands will be demanding more attention-grabbing labels. Particularly with high-value applications, we see the label aesthetics significantly influencing consumers in their purchasing mindsets. This will also involve further use of creative ways of embellishments and is why the sector is poised for sustained growth.

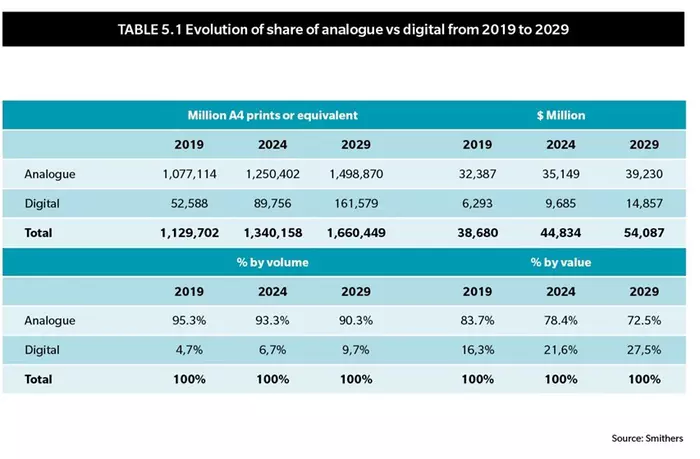

We see the digital market continuing to make real inroads to traditional markets as converters change their mindsets in labels, as well as having a strong focus on driving flexible packaging via a digital route and looking more at the benefits of embellishment.

This is a view backed up by experts. “The key trends in label printing are related to the increasing adoption of digital technologies, the increasing adoption of automation and the evolution of software, often incorporating artificial intelligence, to manage print and finishing processes,” according to analysts Smithers1.

Digital print - the growth catalyst

Creating a digital mindset

Paving the way for innovative partnerships

We will continue to work closely in partnership with our customers to help them rethink possibilities. One example in labels is our Austrian customer SONNENTOR that uses our AccurioLabel 230 press among its Konica Minolta technology portfolio.

Digital production enables the company to produce labels for its colourful herbal and fruit teas in different languages for worldwide sales. “We can produce our labels and advertising materials very flexibly which helps with reducing paper waste and unused material,” says Gerhard Leutgeb CEO, SONNENTOR.

Delivering dynamic production efficiency and creativity

At Konica Minolta, one of the ways we have already addressed the fast-evolving sector is through combining the highly versatile AccurioLabel 400 – the latest member of our market-leading (Infosource) AccurioLabel family – and MGI’s JETvarnish 3D Web systems to deliver digital label production efficiency and creativity in a dynamic way.

Among the benefits of the combination are the empowerment of printing companies struggling with rising material costs and labour skill shortages – two challenges that are still with us for the foreseeable future.

Whatever 2025 will bring, we are confident of a brighter future in labels, packaging and embellishment. And with a Labelexpo in Barcelona on the horizon for September, we can’t wait to meet you again in person.

1 Smithers: The Future of Printed Labels to 2029, Executive Summary, Page xxxii

2 Smithers: The Future of Printed Labels to 2029, Executive Summary, Page xxvii

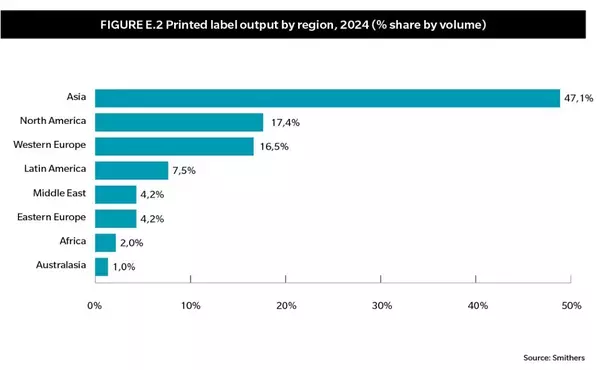

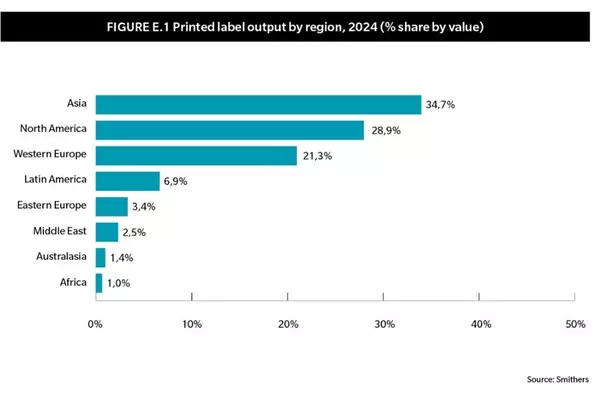

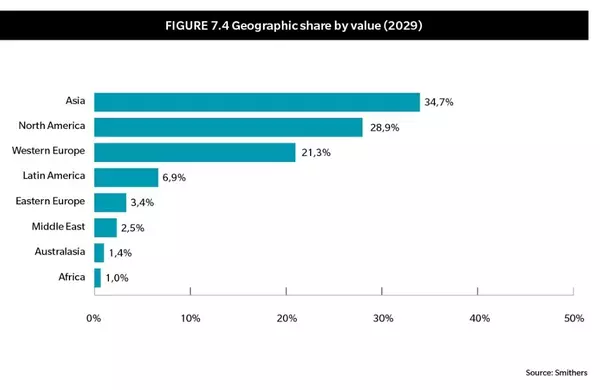

3 Smithers: The Future of Printed Labels to 2029, Label Printing Geographic Markets, Page 158

4 FINAT Radar 25, The European Narrow Web Market, Q3 2024

5 “A Turnaround in Labeling and Product Decoration Market with a Positive Outlook on the Horizon”, AWA Press Release, March 2024

6 Smithers: The Future of Printed Labels to 2029, Label Printing Process Markets, Overview, Page 85